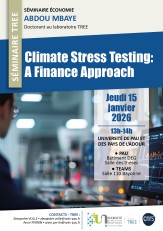

[E] Climate Stress Testing : A Finance Approach.

Le 15 janv. 2026 de 13h00 à 14h00

à Pau, en salle des thèses; à Bayonne en salle 110 via Teams

Abstract :

This article analyzes the impact of climate transition risk on the valuation of companies in the SBF120 index, based on carbon pricing. Using individual company data and a detailed sector classification (ICB), we conduct a climate stress test for the period 2021-2033, in line with the National Low Carbon Strategy. We consider carbon tax scenarios ranging from €45 to €100 per ton of CO₂e. Sectoral shocks to asset values induced by the carbon tax are integrated into a structural credit risk framework based on Merton (1974). The results highlight significant sectoral heterogeneity, with the most pronounced vulnerabilities affecting industrial services, basic resources, chemicals, energy, and retail, for total debt losses of between €755 million and €935 million.